Auto Insurance in and around Fayetteville

Fayetteville's top choice for car insurance

Let's hit the road, wisely

Would you like to create a personalized auto quote?

- Onondaga

- Madison

- Oneida

- Fayetteville

- Jamesville

- Syracuse

- Chittenango

- Manlius

- Cazenovia

- Fabius

- Pompey

- Tully

- Lafayette

- Nedrow

Your Auto Insurance Search Is Over

When it comes to economical car insurance, you have plenty of choices. Sorting through providers, coverage options, savings options… it’s a lot, to say the least.

Fayetteville's top choice for car insurance

Let's hit the road, wisely

Great Coverage For A Variety Of Vehicles

But not only is the coverage fantastic with State Farm, there are also multiple options to save. This can range from safe driver savings like Drive Safe & Save™ to safe vehicle discounts like a passive restraint discount. You could even be eligible for more than one of these options! State Farm agent Lori Mullen would love to explain which you may be eligible for and help you create a flexible policy that's right for you.

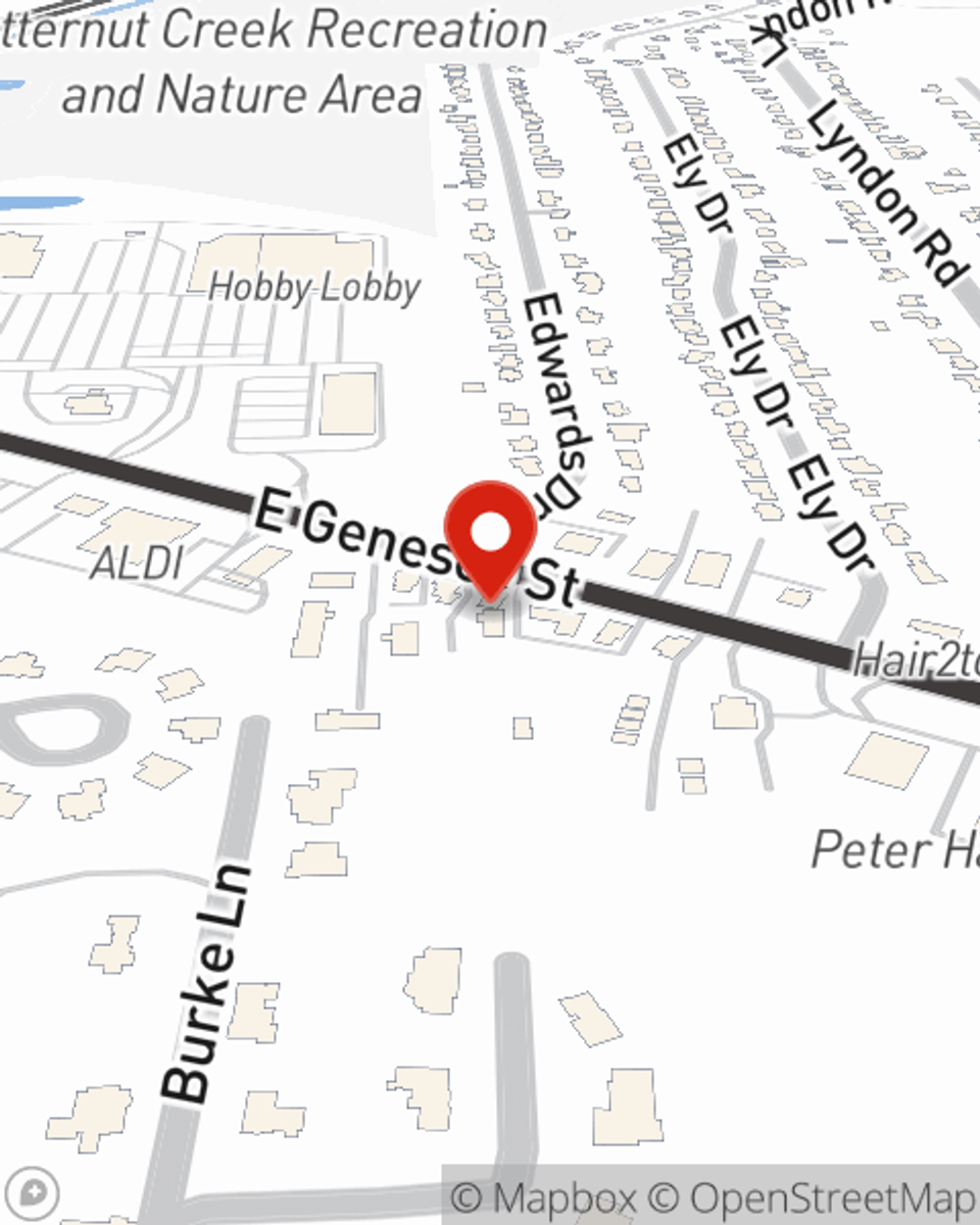

This can include coverage for a variety of situations and vehicles, too, like electric and hybrid cars, antique or classic cars or sports cars. And the benefits of State Farm don't stop there! When the unexpected happens, you can be sure to receive personalized attentive care from State Farm agent Lori Mullen. Visit Lori Mullen's office today!

Have More Questions About Auto Insurance?

Call Lori at (315) 446-4432 or visit our FAQ page.

Simple Insights®

Driving distractions and how to avoid them

Driving distractions and how to avoid them

Driving distractions endanger drivers, passengers and pedestrians. Here are common driving distractions and tips on how you can help avoid them.

Do golf carts need insurance?

Do golf carts need insurance?

Whether you’re hitting the links or the streets in a golf cart, insurance coverage can help keep you protected.

Lori Mullen

State Farm® Insurance AgentSimple Insights®

Driving distractions and how to avoid them

Driving distractions and how to avoid them

Driving distractions endanger drivers, passengers and pedestrians. Here are common driving distractions and tips on how you can help avoid them.

Do golf carts need insurance?

Do golf carts need insurance?

Whether you’re hitting the links or the streets in a golf cart, insurance coverage can help keep you protected.